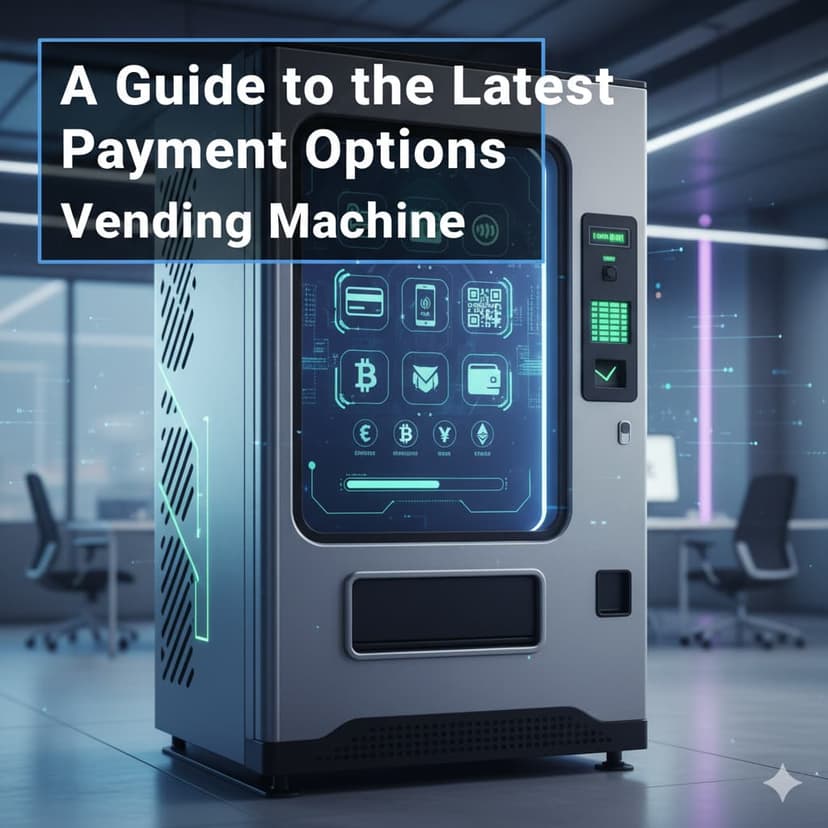

A Guide to the Latest Payment Options Vending Machine

The vending industry has evolved rapidly, moving beyond the era of coin slots and cash-only models. Today’s payment options vending machine technology provides a seamless and modern customer experience with cashless solutions, mobile wallets, and even loyalty features. Businesses investing in advanced vending machine payment methods not only boost sales but also attract tech-savvy consumers. This guide explores the latest systems, important considerations, and future trends shaping vending machine transactions.

Top Cashless Payment Options for Vending Machines

Cashless systems have become the standard in the vending world. By offering multiple payment options vending machine setups, operators can appeal to customers who expect fast, secure, and versatile purchasing. Below are the top solutions widely used today.

Credit and Debit Card Readers

Installing card readers is one of the most common upgrades for vending machines. Customers can simply swipe, insert, or tap their cards to make a purchase. This type of payment options vending machine technology reduces friction at the point of sale and attracts buyers who may not carry cash. Modern card readers are also compatible with EMV chips and contactless features.

Mobile Wallets (Apple Pay & Google Pay)

Mobile wallets are gaining traction because they allow consumers to pay with smartphones or smartwatches. Vending machine Google Pay integration, for example, enables secure tap-to-pay transactions without physical cards. Apple Pay works similarly, offering encrypted data for enhanced security. These vending machine payment methods appeal especially to younger demographics who prefer digital-first lifestyles.

QR Code Payments

A growing number of vending machines now support QR code-based payments. Customers simply scan a code displayed on the machine, pay through their mobile banking app, and instantly receive their product. This type of payment options vending machine solution is affordable for operators and highly convenient for users in regions where QR technology is popular.

Prepaid and Loyalty Cards

Some vending operators issue prepaid cards or link machines with loyalty programs. This encourages repeat purchases and builds customer engagement. For example, FAS Cashback vending machines allow customers to receive rewards or cashback points whenever they use their loyalty-linked card, blending convenience with incentives.

NFC and Contactless Payments

Near Field Communication (NFC) is powering some of the most seamless vending machine payment methods available. Customers only need to hold their card or device close to the reader, completing the purchase in seconds. For businesses, NFC improves transaction speed and reduces queue times in busy locations.

Cryptocurrency Payments

Although not yet mainstream, some payment options vending machine solutions now support Bitcoin and other cryptocurrencies. This futuristic method attracts niche markets, particularly in tech hubs or areas with high adoption of digital assets. While still experimental, it highlights the adaptability of vending technology.

Considerations When Choosing Payment Options

Not every payment options vending machine system suits every business. Operators need to evaluate costs, customer demographics, and technical infrastructure before committing to a solution.

Target Audience and Usage Habits

Understanding customer profiles is essential. For instance, a university campus may benefit from vending machine Google Pay and Apple Pay integration, while an office park might prefer prepaid corporate accounts. Matching vending machine payment methods with consumer behavior ensures higher adoption.

Setup and Maintenance Costs

Adding new technology comes at a price. Card readers and mobile wallet integrations often require subscription fees or transaction charges. While modern payment options vending machine setups boost revenue, businesses must evaluate whether the increased sales justify the cost.

Connectivity Requirements

Some vending systems need Wi-Fi or cellular connections to process transactions. A premium cold vending machine in a high-traffic mall may not face issues, but rural areas could struggle with connectivity. Operators should assess signal strength and invest in backup solutions to avoid downtime.

Security Concerns

Every cashless system requires robust data protection. Operators should look for PCI-compliant hardware and encrypted systems to ensure customer trust. This is especially critical for machines accepting contactless cards and mobile wallets. A secure payment options vending machine builds credibility with customers.

Integration with Existing Systems

Businesses running multiple vending machines may want unified reporting and cashless solutions across their network. Integrating vending machine payment methods with inventory tracking and customer analytics can help streamline operations and maximize profits.

Local Market Preferences

Cultural and regional payment habits influence what works best. For example, in the vending machines UAE market, mobile wallets and contactless cards are widely popular, while in other regions, QR payments dominate. Adapting to local trends ensures higher engagement and smoother operations.

Future Payment Trends for Vending Machines

The future of payment options vending machine technology is exciting, blending artificial intelligence, IoT, and digital commerce. These upcoming trends promise greater convenience and smarter transactions.

Biometric Payments

Fingerprint or facial recognition payments may soon appear in vending machines. This eliminates the need for cards or devices altogether. A biometric-enabled payment options vending machine offers ultra-fast transactions while boosting personalization and security.

Subscription-Based Vending Access

Some companies are experimenting with subscription models where customers pay a monthly fee for access to snacks or drinks. This model, supported by vending machine payment methods, ensures recurring revenue and customer loyalty.

AI-Powered Personalized Offers

AI can analyze buying patterns to suggest products or offer discounts at the point of purchase. For instance, a premium cold Soda Lemon vending machine could suggest a healthier beverage option if a user frequently chooses sugary drinks. Combining AI with advanced payment systems creates a tailored experience.

Integration with Smart Ecosystems

The rise of smart cities and IoT means vending machines will be linked with other automated systems. A payment options vending machine in the future could sync with public transport cards or digital wallets linked to government ID systems, creating an interconnected experience.

Expansion of Digital Currencies

As cryptocurrency adoption grows, more vending machines may start supporting stablecoins or central bank digital currencies (CBDCs). These will provide secure, borderless transactions. Vending machine payment methods will continue evolving to accommodate these digital assets.

FAQ

Are cashless vending machines more expensive to operate than cash-only machines?

Yes, initially. Cashless payment options vending machine setups often involve higher installation costs and transaction fees. However, they typically increase sales by accommodating more buyers who don’t carry cash. Over time, the return on investment outweighs the added costs.

How secure are vending machine credit card readers?

Modern readers are highly secure, using encryption and PCI-compliant systems. As long as operators choose reputable providers, vending machine payment methods are as safe as traditional retail card readers.

Can a single vending machine accept every type of payment (cash, card, mobile)?

Yes, multi-system payment options vending machine models exist. These allow cash, card, mobile wallets, QR codes, and even cryptocurrency, ensuring no customer is excluded.

Does a card reader need Wi-Fi to process payments?

Some do, while others use cellular connections. A payment options vending machine in high-traffic areas usually relies on Wi-Fi for stability, but backup cellular options can ensure continuous operation.

Why do some vending machines still only take cash?

Older machines may not support modern upgrades, or operators may avoid cashless systems due to costs or limited connectivity. While vending machine payment methods are advancing, certain regions or low-demand locations still rely on cash-only models.

Also Read: Vending Machine Maintenance